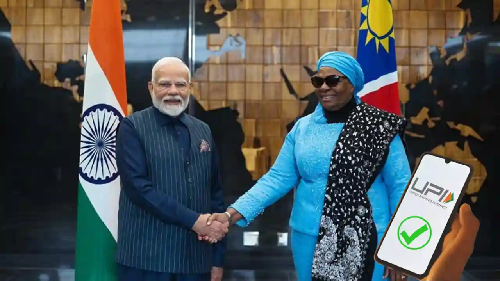

In a landmark move for India-Africa digital cooperation, Namibia has become the first African nation to officially adopt a digital payments system modeled on India’s successful Unified Payments Interface (UPI). The announcement was solidified during a recent visit by Prime Minister Narendra Modi to the Southern African nation, cementing a major strategic victory for India’s digital diplomacy efforts.

The adoption follows a technology licensing agreement signed in April 2024 between the Bank of Namibia (BoN) and the NPCI International Payments Limited (NIPL), the global arm of India’s National Payments Corporation of India (NPCI).

While several other countries have adopted the UPI platform for payments between Indian and local merchants, Namibia is the first country globally to sign a direct licensing agreement with NPCI to use the core UPI technology to build its own domestic real-time payment infrastructure. This allows Namibia to implement a system tailored for its local banks and citizens.

The UPI-based system, scheduled for rollout later in 2025, is set to revolutionize Namibia’s financial landscape by offering:

- Instant Payments: Enabling 24×7, real-time fund transfers between individuals and merchants.

- Financial Inclusion: Providing an accessible, low-cost digital payment solution for a wider population, reducing reliance on cash.

- Digital Leadership: Positioning Namibia as a fintech leader in the African continent.

The agreement highlights the growing international recognition of India’s Digital Public Infrastructure (DPI) as a model for emerging economies. Officials from both nations noted that this partnership extends beyond finance, deepening bilateral cooperation in defense, healthcare, agriculture, and critical minerals. Namibia’s decision is seen as a major catalyst for other African nations currently in discussions with India to develop their own UPI-inspired payment platforms.