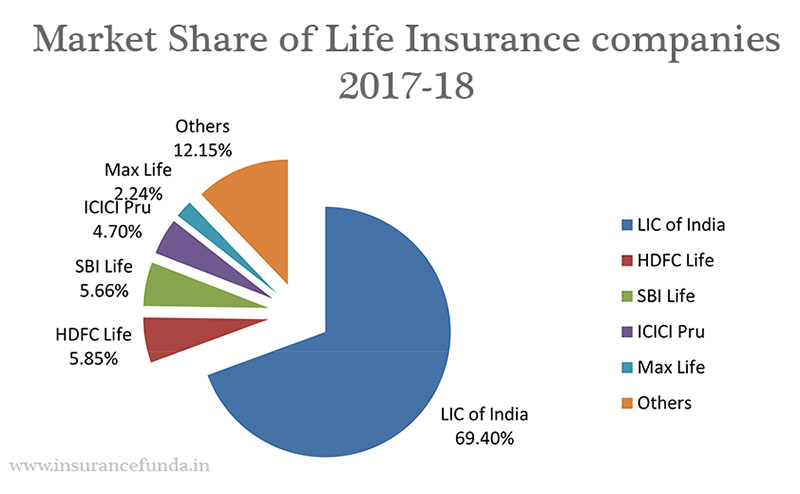

The Life Insurance Corporation of India (LIC) continues to hold the title of India’s largest insurance company, dominating the life insurance sector by market share, policyholder base, and assets under management (AUM).

Established on September 1, 1956, after the nationalization of 245 private insurers, LIC has grown into one of the world’s largest insurance companies, with more than 290 million policyholders and managing assets worth over ₹45 lakh crore.

“LIC is not just the largest in India—it’s a global giant in terms of life insurance operations,” noted a senior analyst at IRDAI.

LIC commands a life insurance market share of over 62% (as of recent data) and has a distribution network of over 13 lakh agents, with presence in both urban and rural India. It also remains one of the largest institutional investors in Indian equities and infrastructure.

- Name: Life Insurance Corporation of India (LIC)

- Founded: September 1, 1956

- Ownership: Government of India

- Market Share: Over 62% in life insurance segment

- Assets Under Management (AUM): ₹45+ lakh crore

- Policyholders: 290+ million

- Network: 2,000+ branches, 13 lakh+ agents, digital platforms

- Listed: IPO launched in May 2022

Despite the rise of private insurers such as HDFC Life, SBI Life, and ICICI Prudential, LIC maintains a commanding lead in the sector due to its legacy trust, pan-India reach, and diverse product portfolio.