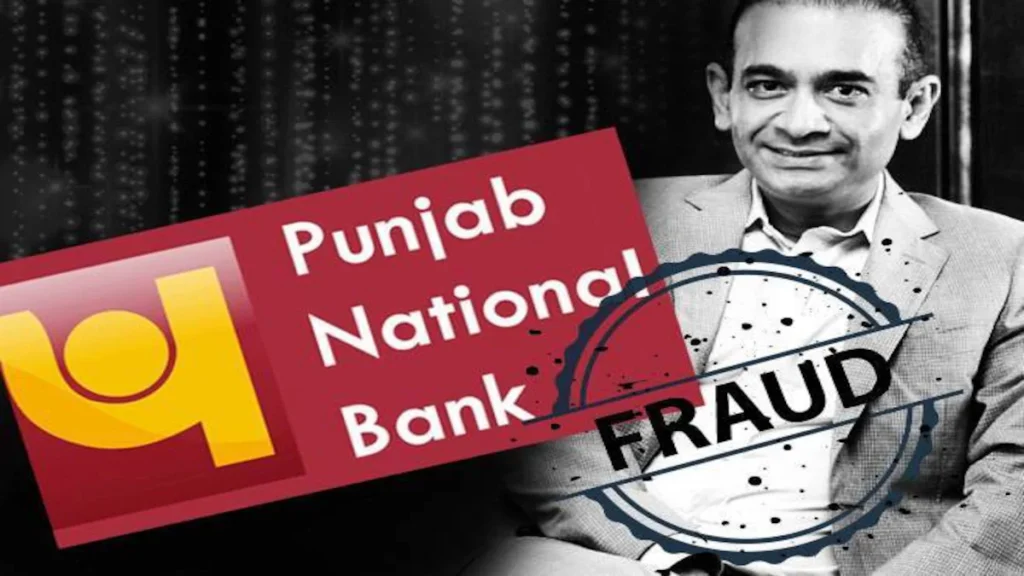

In an unprecedented financial scandal, Punjab National Bank (PNB), one of India’s largest public sector banks, uncovered a massive ₹13,000 crore scam involving fraudulent credit guarantees allegedly orchestrated by billionaire jeweler Nirav Modi and his uncle Mehul Choksi.

The fraud, executed over several years from PNB’s Brady House branch in Mumbai, involved the illegal issuance of Letters of Undertaking (LoUs)—bank guarantees used for securing overseas credit—without proper authorization or collateral. These LoUs were allegedly issued by a handful of bank officials in collusion with Modi’s companies, bypassing the core banking system and internal checks.

“This is the biggest fraud in Indian banking history,” said a senior government official. “It has exposed major gaps in operational control and regulatory oversight.”

The scam came to light when PNB reported it to the Reserve Bank of India (RBI) in early 2018, sparking national and international investigations. The CBI and Enforcement Directorate (ED) began a large-scale crackdown, arresting several PNB officials and launching global manhunts for Modi and Choksi.

Nirav Modi was later arrested in London and is currently facing extradition proceedings. Mehul Choksi fled to Antigua and Barbuda, where he had acquired citizenship before the scam broke. Both are wanted in India on charges of fraud, criminal conspiracy, money laundering, and breach of trust.

- Bank Affected: Punjab National Bank (PNB)

- Fraud Amount: ₹13,000+ crore

- Accused: Nirav Modi and Mehul Choksi

- Location of Fraud: PNB Brady House branch, Mumbai

- Method: Fraudulent Letters of Undertaking (LoUs)

- Year Exposed: 2018

The scam led to sweeping reforms in India’s trade finance systems, tighter SWIFT integration with core banking software, and increased regulatory vigilance by the RBI. It also sparked a nationwide debate on the accountability of bank officials and the safety of public funds.

The PNB scam remains a cautionary tale of how high-level collusion and weak internal controls can lead to catastrophic losses, prompting India’s banking sector to adopt tougher checks and digital surveillance measures.