In a landmark move towards financial sovereignty, the National Payments Corporation of India (NPCI) unveiled the RuPay debit card, India’s first indigenous payment card, at a formal launch event held in Mumbai.

Designed to reduce dependency on international payment networks like Visa and MasterCard, RuPay is a major step forward in providing a cost-effective, secure, and domestic alternative for Indian consumers and banks.

“RuPay is a symbol of India’s self-reliance in the financial sector,” said NPCI officials. “It brings inclusive, affordable card-based services to every Indian.”

Named by blending ‘Rupee’ and ‘Payment’, RuPay was developed by NPCI with the aim of promoting wider financial inclusion, particularly in rural and semi-urban areas where banking penetration is limited. The card operates on a domestic processing network, lowering transaction costs and increasing security by keeping data within the country.

Initially rolled out with select public sector banks and regional rural banks, the RuPay network has since expanded exponentially across commercial banks, ATMs, and POS terminals nationwide.

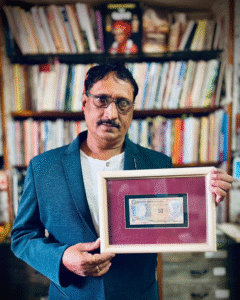

- Card Name: RuPay

- Launched by: National Payments Corporation of India (NPCI)

- Launch Date: 26 March 2012

- Location: Mumbai, Maharashtra

- Purpose: First Indian-made payment card for domestic transactions

- Features: Lower fees, domestic data processing, financial inclusion focus

With RuPay, India began its journey towards card payment independence, and it has since become an integral part of the country’s Digital India mission, now accepted in over 200 countries and widely used through Jan Dhan accounts and UPI-linked services.