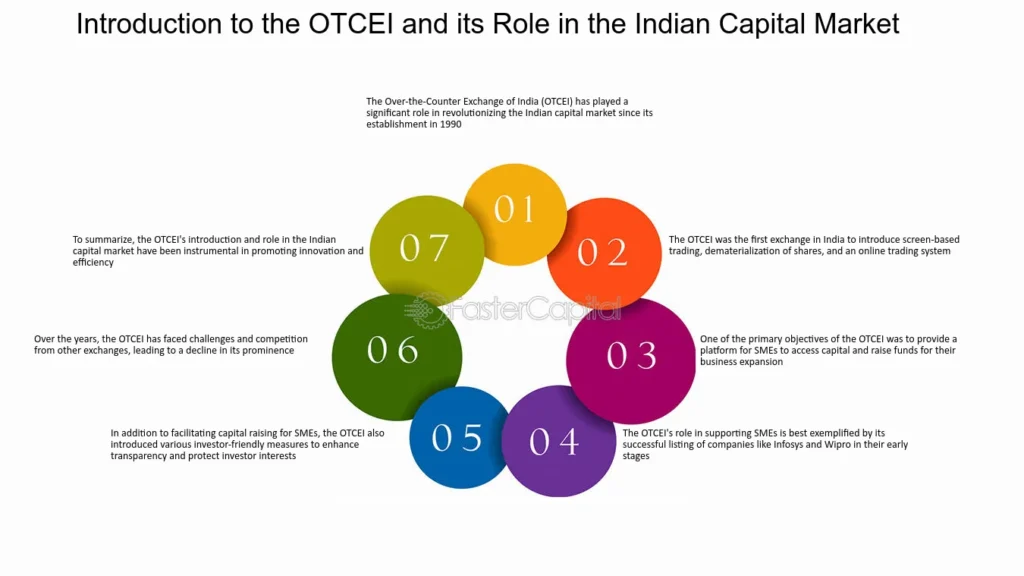

The Over The Counter Exchange of India (OTCEI) made history by becoming the first automated stock exchange in India to introduce screen-based electronic trading, marking a pivotal transformation in the way securities were bought and sold in the country.

Launched in 1992, OTCEI was promoted by premier financial institutions such as IDBI, UTI, ICICI, LIC, GIC, and SBI Capital Markets. It was established to provide small and medium-sized companies access to capital markets and to bring in greater transparency and efficiency in trading operations.

“The OTCEI marked a revolutionary shift from floor-based open outcry systems to a fully computerized, screen-based platform,” said a former IDBI official involved in its creation.

With this, India took a major step toward modernizing its financial infrastructure, eventually influencing the National Stock Exchange (NSE), which followed with its own screen-based trading system in 1994.

- Initiative: First automatic and screen-based stock exchange in India

- Exchange: Over The Counter Exchange of India (OTCEI)

- Launched: 1992

- Promoters: IDBI, ICICI, UTI, LIC, GIC, SBI Caps

- Purpose: Capital access for small and mid-sized companies, transparency in trading

- Legacy: Paved the way for electronic trading systems used today

Though OTCEI eventually lost momentum due to market consolidation and regulatory changes, its role in introducing digitized, investor-friendly trading platforms remains a landmark moment in Indian financial history.