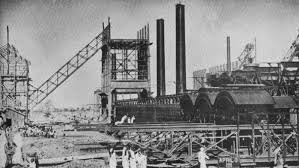

In a historic financial move, the Tata Iron and Steel Company Ltd (TISCO) — now Tata Steel — became the first Indian company to issue secured promissory notes, marking a revolutionary step in India’s corporate financing landscape.

This groundbreaking issuance introduced the concept of secured debt instruments in India, where the promissory notes were backed by tangible assets of the company, offering enhanced security and confidence to lenders and investors.

“TISCO’s secured promissory notes set the foundation for structured corporate borrowing in India. It was a game-changing moment for Indian industry and banking,” noted a senior economist.

- Issuer: Tata Iron and Steel Company Ltd (TISCO)

- Instrument: First Secured Promissory Notes in India

- Significance: Introduced the use of asset-backed corporate debt

- Impact: Boosted lender confidence and modernized India’s industrial credit practices

Prior to this, promissory notes in India were largely unsecured, posing higher risks for creditors. TISCO’s bold move brought a new level of trust and structure to the corporate lending ecosystem, influencing other industrial houses and financial institutions to adopt similar practices.

This historic innovation played a key role in shaping India’s secured lending framework and helped lay the foundation for today’s modern corporate debt instruments, including debentures, bonds, and structured finance products.